EXCLUSIVE: Liberals dished out $7.1 BILLION on child supports for non-citizens

The Liberal government has revealed that it spent over $7.1 billion in taxpayer dollars on childcare for non-permanent residents and other non-citizens over the last nine years.

The Liberal government has revealed that it spent over $7.1 billion in taxpayer dollars on child supports for non-permanent residents and other non-citizens over the last nine years.

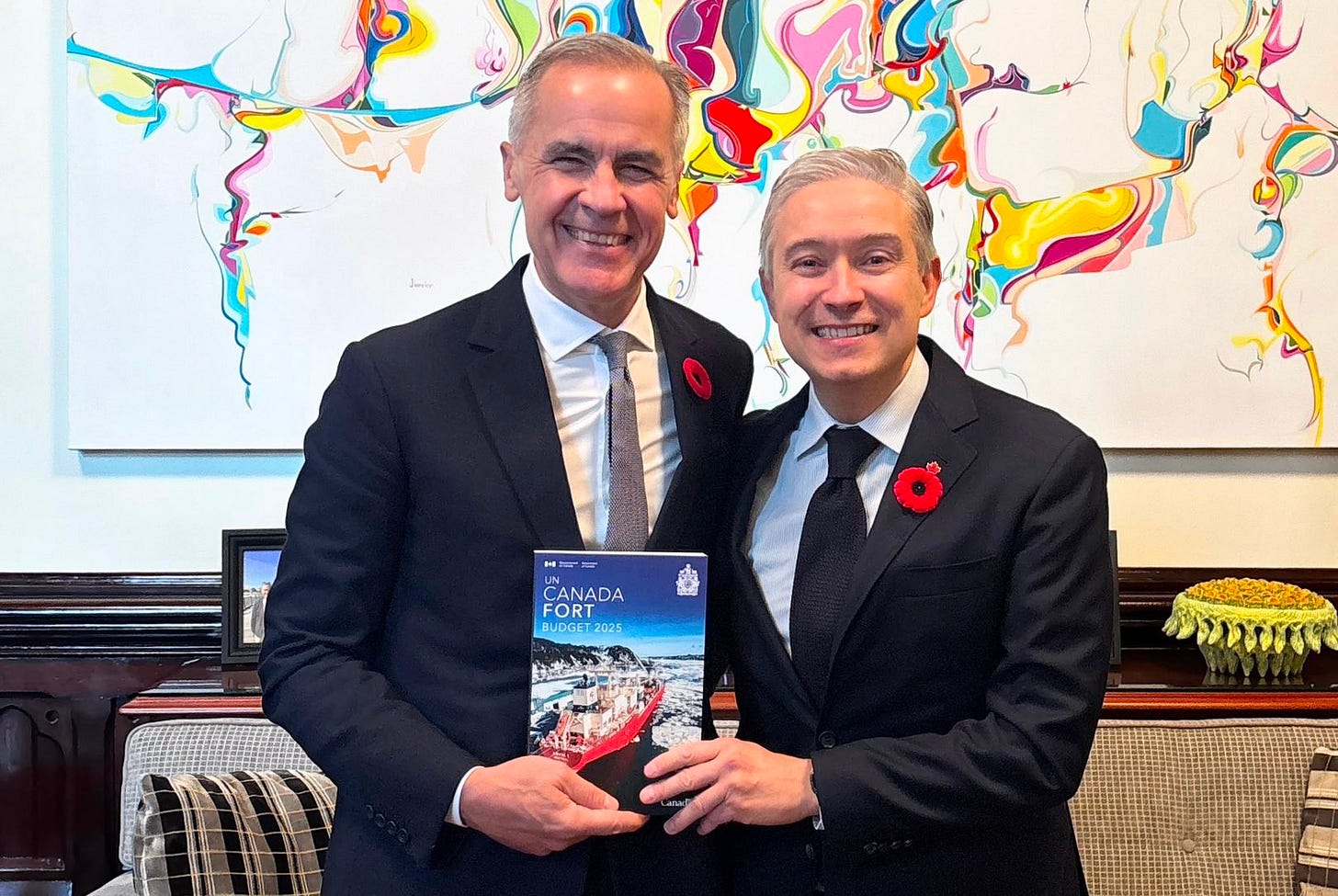

In a written response to a question from Conservative MP Brad Vis, the Liberal finance minister, François‑Philippe Champagne, revealed that nearly $7.134 billion in Canada Child Benefit (CCB) payments went to people in Canada who were temporary residents, protected persons, or “other non-citizens” after excluding permanent residents.

The response broke down the number of citizens, permanent residents, and others who received the CCB, as well as the total amount paid for each year since 2016.

Champagne revealed that $241.5 billion has been paid out to program recipients since 2016.

In the first year, over 60,000 non-permanent residents and non-citizens received more than $318 million from the CCB. By 2024, there were over 160,000 temporary residents, protected persons and other non-citizens who received nearly $1.17 billion.

In the first nine months of 2025, there is already an over 17.5 per cent increase in the number of non-citizens and non-permanent residents receiving the CCB. There were also 2.56 per cent more tax dollars spent on the 188,000 recipients, with over $1.2 billion given to non-citizens and non-permanent residents in Canada in childcare benefits.

The Ministry of Finance did not respond to True North’s requests to comment on how the government justifies giving Canadians’ tax funds to non-permanent residents and non-citizens.

However, Champagne revealed in his response to Vis that for a non-citizen or non-permanent resident to “meet both general eligibility and specific immigration-related requirements” to receive the fund, the individual must be a resident of Canada for tax purposes or be a “protected person” such as an asylum seeker.

For temporary residents, recipients must have “lived in Canada for the previous 18 months continuously” and have a “valid immigration permit in the 19th month.”

The Canada Revenue Agency claimed it doesn’t track the number of non-citizens or non-permanent residents who have had their claims for the childcare benefit denied.

We sure have some stupid politicians running the country. But then again you need to look at the people that keep voting for them.

Yes, eh? Yet they won`t use the "Non withstanding clause" to stop the Supreme Court of Canadas ruling about child predators in Canada?