POLL: Are you getting value for your tax dollars?

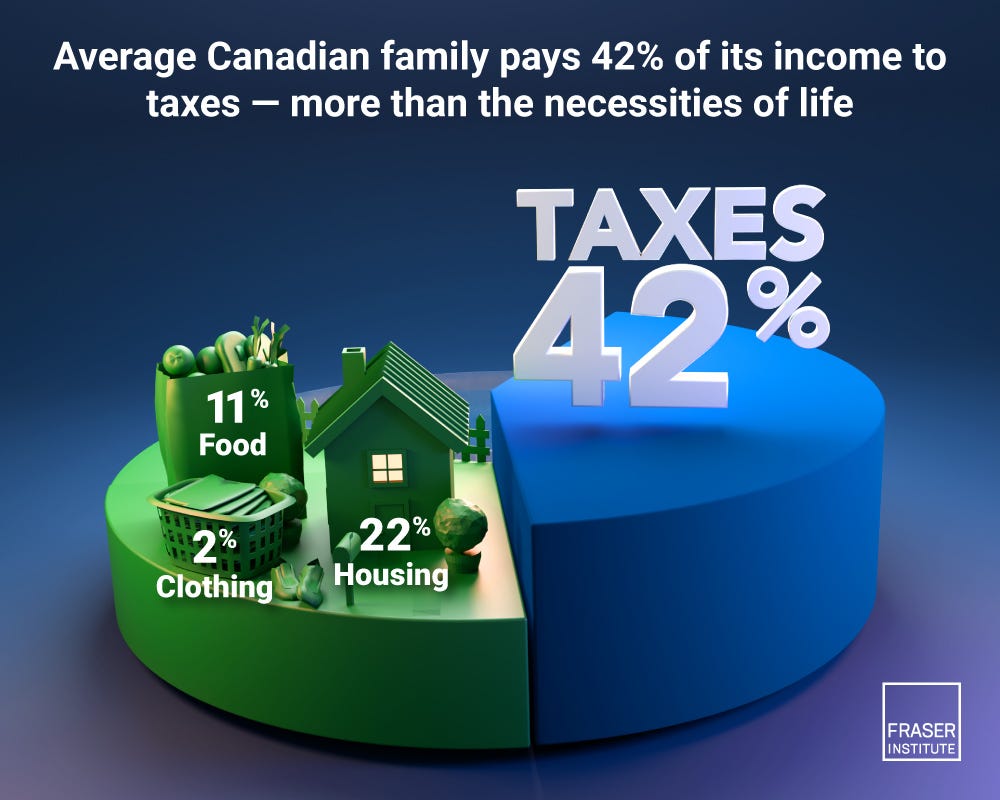

A new report reveals that the average Canadian family forked over nearly half of its income on taxes last year. That's more than they spent on essentials like food, housing, and clothes combined.

NOTE: Only subscribers - free OR paid - can vote. If you can’t vote, subscribe HERE.

A new report reveals that the average Canadian family forked over nearly half of its income on taxes last year. That's more than they spent on essentials like food, housing, and clothes combined.

The 2025 edition of the Canadian Consumer Tax Index from the Fraser Institute revealed that a typical family earning $114,289 in 2024 paid $48,306 in taxes to all levels of government. Taxes remain the largest household expense for families in Canada, according to Jake Fuss, director of fiscal studies at the Fraser Institute.

Canadians pay 42.3 per cent of their income in taxes, compared to 35.5 per cent on basic necessities such as housing, food and clothing.

The trend mirrors last year’s report, which showed that Canadian families paid 43 per cent of their income to taxation and spent 35.6 per cent on basic necessities.

The 2025 report found that income taxes were the largest component of the average tax bill, accounting for $15,085, or 31.2 per cent. Payroll and health taxes came next at $10,319 (21.4 per cent), followed by sales taxes at $6,812 (14.1 per cent). Property taxes, fuel and carbon levies, excise taxes and other charges made up the rest.

“While Canadians can decide for themselves whether or not they get good value for their tax dollars, they should understand how much they pay in taxes each year,” said Fuss.

The study showed that the tax burden has grown significantly over time. In 1961, the average family paid 33.5 per cent of its income in taxes and 56.5 per cent on necessities. Today, those numbers have flipped. Since 1961, the total tax bill has risen by 2,784 per cent, outpacing increases in food, housing and clothing costs, as well as inflation, which has increased by 925 per cent in that time frame.

“The tax bill has grown more rapidly than any other single expenditure item,” concluded the report.

The record-high tax bill for Canadians hitting a record high has coincided with the federal bureaucracy swelling to a record 445,000 employees in 2024-25.

The Fraser Institute report comes amid heightened public concern about affordability and tax burdens. A recent survey from the Montreal Economic Institute found that 72 per cent of Canadians believe their tax bill has lowered their quality of life.

“Canadians are not on board with Ottawa’s fiscal path,” said Samantha Dagres, communications manager at the MEI. “Canadians feel they’re being squeezed by a government that is increasingly an impediment to their standard of living.”

A separate study showed that Canadians pay about 70 per cent more in income taxes than Americans. Even in the highest-taxed U.S. states, the burden is lighter.

“This is more proof that Canadians are overtaxed. Canadians pay too much tax because our governments waste too much money,” said Franco Terrazzano, federal director of the Canadian Taxpayers Federation.

While all taxpayers are paying a heavy burden, the weight is heavier at the top. A separate study from the Fraser Institute found that the top 20 per cent of families pay almost 60 per cent of all taxes.

Despite these findings, the Carney government has proposed only minor tax relief, including a one-point cut to the lowest federal bracket, which is estimated to save the average Canadian about $400 annually.

Prime Minister Mark Carney, who formerly served in leadership roles at Brookfield Asset Management, was accused of helping the company avoid about $5.3 billion in Canadian taxes.

In Carney’s recently released conflict of interest disclosure, where he listed 103 companies, Brookfield is listed 29 times.

“If this new federal government wants to make the Canadian dream into a reality again, it will need to do much more than a one percentage point cut to the first tax bracket,” said Renaud Brossard of the MEI.

WE should be looking after CANADIANS FIRST then we can supply aid to those in need if we have the cash to do so.

MC looks after himself like JT did and if there are any crumbs left then we get a little.

1. Income taxes are temporary, circa 1914 —WW1

2. All taxes are an investment in Canada, circa — 1968, Trudeau

3. Taxes are a way of life…

Time for change way past due….

Minimize government bureaucracy, let’s eliminate hundreds of billions annually, on an ongoing basis.