Gold reserves sold by Trudeau Liberals would be worth double today

The Trudeau government lost over $150 million in missed profits after selling off Canada’s gold reserves in 2015-16, which is now worth more than double what it was then.

The Trudeau government lost over $150 million in missed profits after selling off Canada’s gold reserves in 2015-16, which is now worth more than double what it was then.

The government of Canada pursued a multi-year strategy of selling off the country’s gold reserves in favour of hoarding other countries’ currencies.

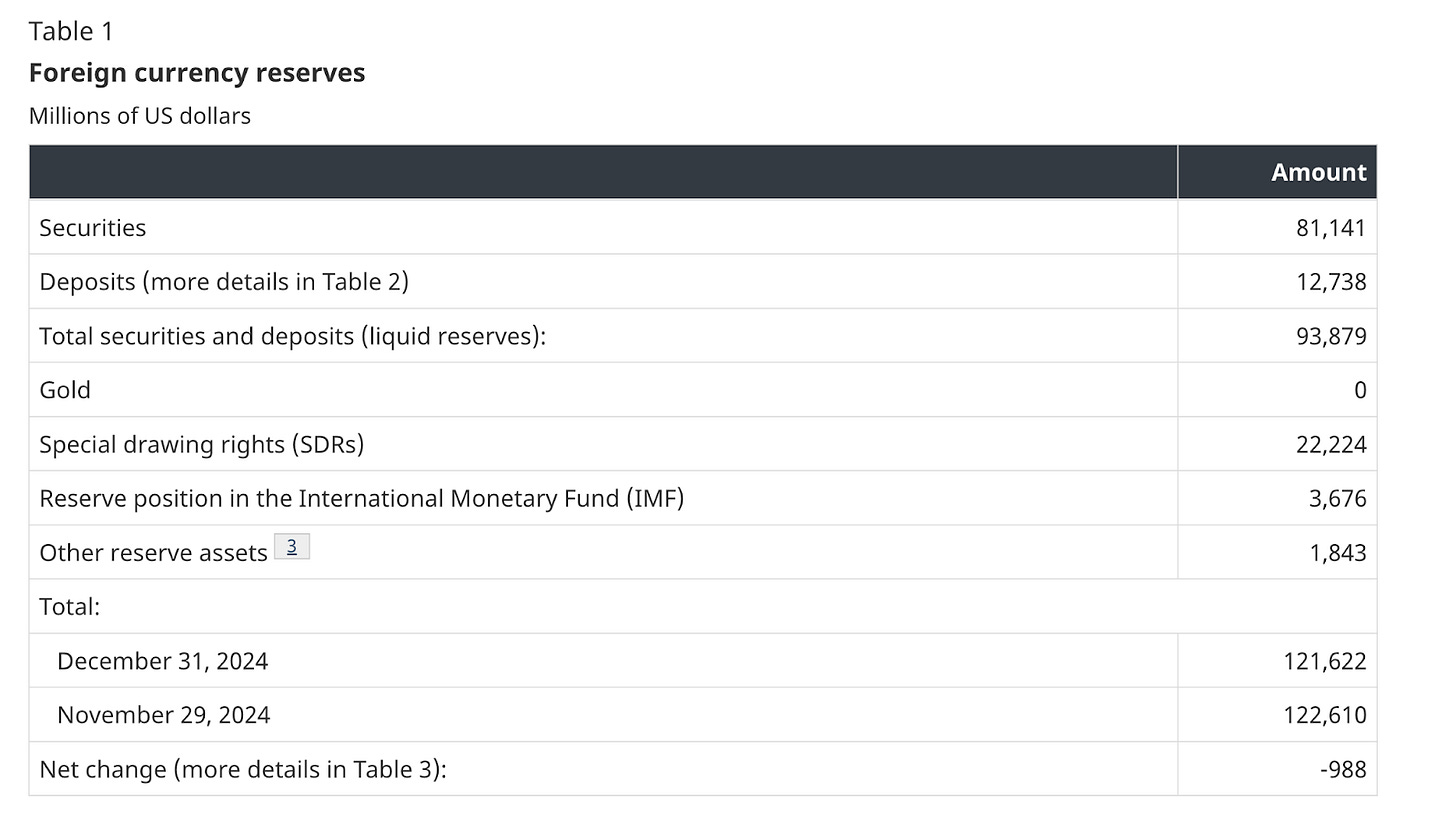

According to the Department of Finance, Canada’s official gold reserves went to $0 by late February 2016, a value that Ottawa assigns to its gold holdings from an accounting perspective, where it presently remains.

As of March 2016, Ottawa still had 77 ounces of gold, consisting of gold coins.

However, the value of gold sits at $4,617 per oz. as of this month, almost triple what the Liberals sold it for at the height of its value at $1686.07 per oz., with a lowest rate being sold at $1447.27 per oz.

During their two-year selling spree, the Trudeau government sold off 95,817 oz. of gold, selling 41,106 oz. in December 2015, 32,860 oz. in January 2016, and 21,851 oz. in February 2016.

The total sales earned the government $146,092,450, but those reserves would be worth about $297 million today.

The Department of Finance did not respond to True North’s request for comment.

However, a department spokesman, David Barnabe, told CBC News in March 2016 the “decision to sell the gold was not tied to a specific gold price, and sales are being conducted over a long period and in a controlled manner.”

“The government has a long-standing policy of diversifying its portfolio by selling physical commodities (such as gold) and instead investing in financial assets that are easily tradable and that have deep markets of buyers and sellers,” said Barnabe.

Ottawa’s gold holdings peaked in 1965 with 1,023 metric tonnes, but the government has been steadily selling off its reserves ever since, with only 3.4 metric tonnes remaining in 2003.

Meanwhile, countries such as Russia, India, and China have been steadily bolstering their gold reserves.

No surprises here.

Simply more evidence that everything this farce of a PM with a weird sock fetish touched turned to that which one picks up after one's dog.

Not only are most Canadians unaware and unconcerned with this travesty, but they are also oblivious as to what SDRs on our central bank's balance sheet represent - or even what an SDR is. If more Canadians would take the time to understand our monetary policy and foreign influence on domestic policy, then they might better understand where our nation is headed.