BREAKING: Grocery prices surge once again: Statscan

Canadians felt the pinch at the grocery store last month as food prices continued to climb, contributing to a 2.4 per cent annual increase in the Consumer Price Index for September.

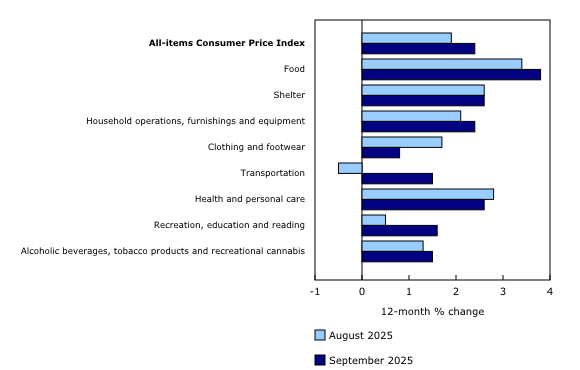

Canadians felt the pinch at the grocery store last month as food prices continued to climb, contributing to a 2.4 per cent annual increase in the Consumer Price Index (CPI) for September. Economists had expected a 2.2 per cent increase.

Grocery prices rose 4 per cent year-over-year in September, following a 3.5 per cent increase in August, according to Statistics Canada’s latest report.

“Inflation jumps again with all four measures above the Bank of Canada’s target,” said Conservative Leader Pierre Poilievre on Tuesday. “Food prices are rising at twice their benchmark. The cost of Carney’s inflationary deficits is higher prices for heating, eating, and housing.”

This rapid price growth was driven by increases in fresh vegetables, sugar and confectionery.

“Year-over-year grocery price inflation has generally trended upward since its most recent low in April 2024 (+1.4 per cent),” the report stated. “Grocery items contributing to the general acceleration included fresh or frozen beef and coffee, both due, in part, to lower supply.”

Meanwhile, gas prices fell at a slower pace in September (-4.1 per cent) compared to August (-12.7 per cent), “due to a base-year effect, leading to an acceleration in headline inflation.”

“Excluding gasoline, the CPI rose 2.6 per cent in September, after increasing 2.4 per cent in August,” the report read.

“In September 2024, prices fell 7.1 per cent month over month due, in part, to lower crude oil prices amid growing concerns of weaker economic growth, particularly in China and the United States.

In September 2025, gasoline prices rose 1.9 per cent on a monthly basis following refinery disruptions and maintenance in the United States and Canada, which put upward pressure on prices.”

Tuition fees also increased this year at a similar pace to 2024. However, excluding 2019, the 2025 increase was the smallest since 1976, when the index was unchanged.

The clothing and footwear index saw a modest jump of 0.8 per cent in September, helping to temper the overall Consumer Price Index.

Next week, the Bank of Canada is set to decide on whether to again lower interest rates. While the Bank would generally respond to the slowing economy with further cuts to key interest rates, increasing inflation will complicate their decision-making.

Thanks Mr Carney and all of you that supported this raging lunatic!! He will ALWAYS be loyal to the global elitists and to the account holders at Brookfield. He does not give a rats a** about the rest of us. Thanks to all of you that supported this clown and now more and more, life is getting impossible to afford. And then you wonder why there's so many people that are homeless

No-one ever mentions the low Canadian dollar which will stay low until there is economic activity which draws in foreign capital. That can only happen when Carney takes the brake off all activity and allows job creating to flourish.

It would not take much real activity to allow the dollar to go up a minor 5% which would have a major effect on food prices with a side benefit that the Canadians wintering in the south would have more loot.