Carney’s former Brookfield labelled Canada’s largest corporate “tax dodger”

Carney’s former company may be the largest “tax dodger” among Canadian corporations, according to an expert testimony given at a recent Standing Committee on Access-to-Information, Privacy and Ethics.

Prime Minister Mark Carney’s former company may just be the largest “tax dodger” among Canadian corporations, according to an expert testimony given at a recent Standing Committee on Access-to-Information, Privacy and Ethics.

Carney’s former company, Brookfield Asset Management, was cited as among the top Canadian corporations in having a colossal tax gap, worth more than $6.5 billion between 2017 and 2021, during a meeting held to review the Conflict of Interest Act.

The Canada Revenue Agency refers to a tax gap as “the difference between the taxes that would be paid if all obligations were fully met in all instances, and taxes that are actually paid and collected.”

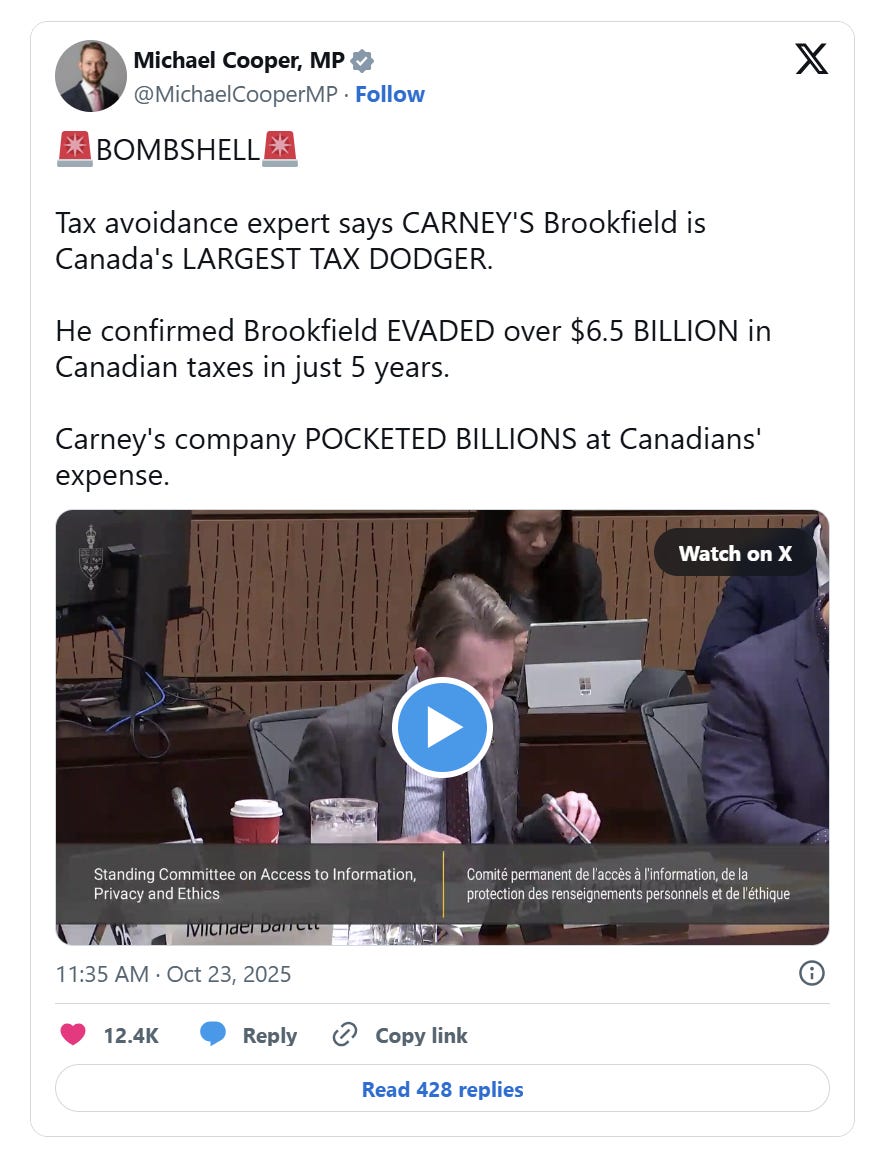

“Brookfield’s tax gap in just five years, between 2017 and 2021, was over $6.5 billion, is that correct?” asked Conservative MP Michael Cooper of principal analyst Jason Ward on Wednesday.

Ward, who works for the Center for International Corporate Tax Accountability and Research, published a 2023 report on the issue.

“That’s correct,” said Ward. “That was based on research done by Canadians for Tax Fairness and by some analysts with the Toronto Star as well.”

Cooper asked Ward whether it would be “fair to say” that the extent of Brookfield’s tax gap, or taxes that “should have otherwise paid in Canada,” had surpassed $6.5 billion.

Canadians for Tax Fairness is a non-profit, non-partisan organization that advocates for fair and progressive tax policies.

“Brookfield’s tax gap over the last five years (2017-2021) was over $6.5 billion, with more than half of the total in the most recent year,” reads the CICTAR report.

“While Canada’s federal public sector workforce, including the Canada Revenue authority, went on strike to achieve wage increases that match inflation, Brookfield appears to have avoided billions in tax payments in Canada.”

While Ward said that there are sometimes “legitimate reasons” for such discrepancies, Brookfield’s tax gap was certainly “an indication of a major underpayment of taxes, that, in the spirit of the law, should have been paid in Canada to finance public services in Canada.”

Cooper followed up by asking Ward if it would be fair to call Brookfield “Canada’s largest tax dodger amongst corporations?”

Ward noted that the company had already previously “been labelled as such.”

“If it’s not the largest, it’s clearly in the very top tier,” he added.

Cooper went on to say the CICTAR report reviewed 123 of Canada’s largest corporations and found that the largest tax gap over that five-year period was “none other than Brookfield, right?”

“Correct,” responded Ward.

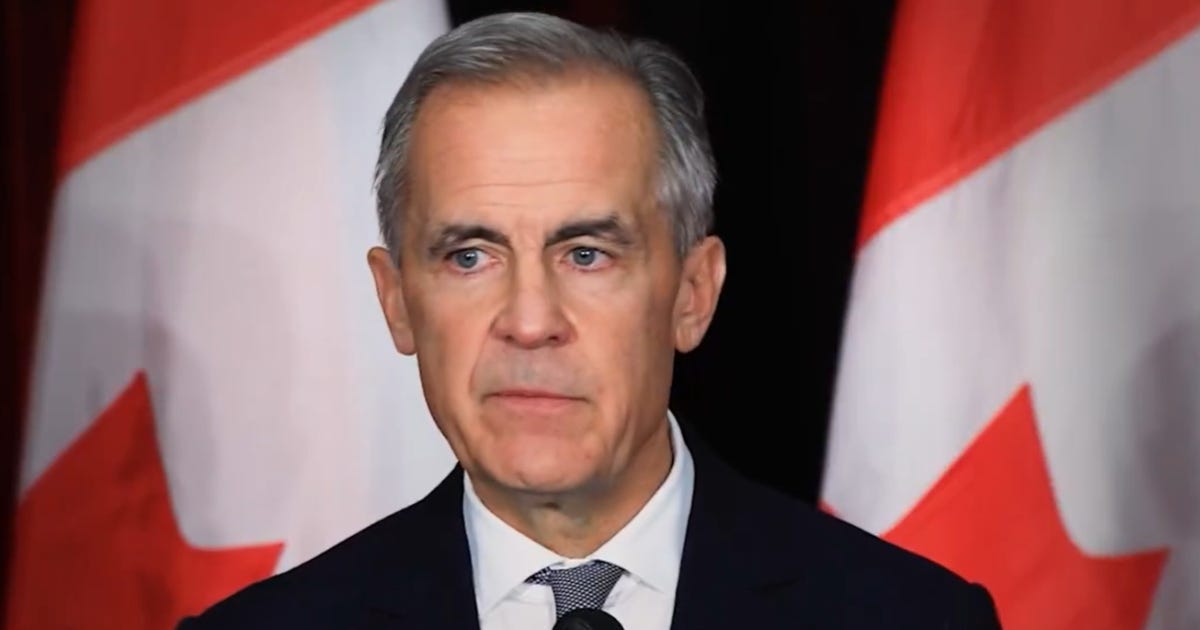

Carney has faced much scrutiny over his personal conflicts of interest ever since he entered the Liberal leadership race.

Criticism first began to mount after he first refused to submit his ethics disclosure until after he won the race and assumed the role of prime minister in February.

Once Carney was finally forced to present his federal ethics disclosure in July, it became public that he holds 103 assets that pose potential conflicts, an unprecedented number for a sitting prime minister.

During the election campaign, Carney had repeatedly claimed he had no such conflicts.

Carney stepped away from Brookfield upon entering the Liberal leadership race in January. He had previously served as the company’s vice chair and head of ESG and Impact Fund Investing since 2020.

However, he still holds $6.8 million in Brookfield shares in a blind trust.

"Former" company, hah! It's becoming increasingly clear that Carney is using the office of PM for no other purpose than to enrich Brookfield, and by extension, himself.

I doubt there is anything 'former' about Carney and Brookfield.