Canada’s real GDP per capita flatlined while U.S. economy surges ahead

While the U.S. economy has enjoyed a recent surge, Canada’s economic growth has been stagnant for the past six years.

While the U.S. economy has enjoyed a recent surge, Canada’s economic growth has been stagnant for the past six years.

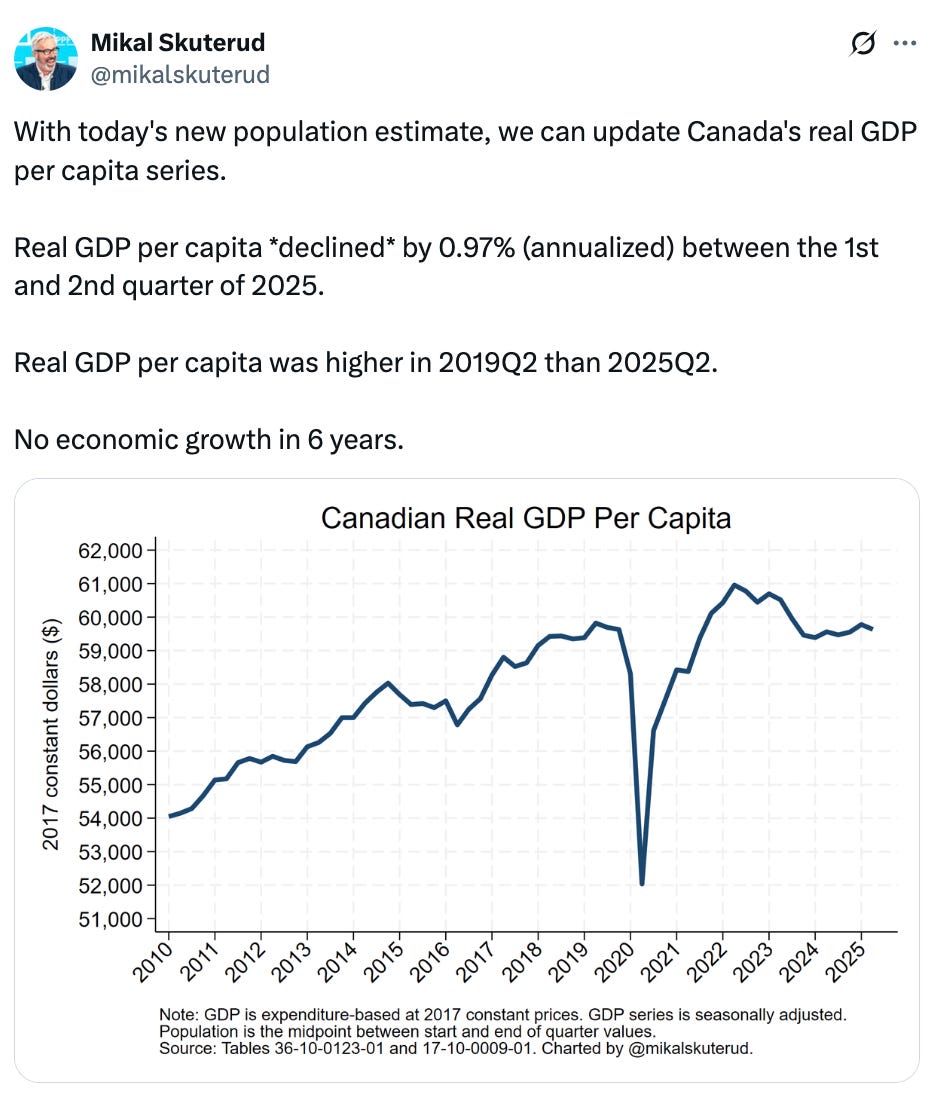

University of Waterloo Economist Mikal Skuterud noted Thursday that Canada’s real GDP per capita fell at an annualized rate of 0.97 per cent between the first and second quarters of 2025, according to updated population estimates.

Real GDP per person was higher in the second quarter of 2019 than in 2025, showing “no economic growth in six years.”

By contrast, the U.S. economy expanded at a 3.8 per cent annual pace from April through June, a sharp upgrade from the government’s earlier 3.3 per cent estimate, the Associated Press reported.

Consumer spending rose 2.5 per cent, up from 0.6 per cent in the first quarter and well above the 1.6 per cent previously estimated.

The spring rebound followed a 0.6 per cent first-quarter drop in U.S. gross domestic product, caused largely by a surge in imports ahead of President Donald Trump’s latest tariffs. Imports then fell 29.3 per cent, boosting second-quarter growth by more than five percentage points.

A key measure of underlying U.S. economic strength, which includes consumer spending and private investment, grew at a 2.9 per cent annual pace, up from 1.9 per cent in the first quarter.

The contrast leaves Canada’s economy looking stagnant. With real output per person still below its pre-pandemic peak, Canada has seen no per-capita gains since mid-2019.

South of the border, American households helped deliver a second-quarter performance strong enough that analysts say it could slow the Federal Reserve’s plans to cut interest rates later this year. The Federal Reserve also reported that its chair is signalling an incoming slow cut on the interest rates.

The Bank of Canada cut interest rates by 25 basis points last week.

The Bank’s Governor, Tiff Macklem said in a statement that “with a weaker economy and less upside risk to inflation, the Governing Council judged that a reduction in the policy rate was appropriate to better balance the risks going forward.

Just leave government out of the economy. Need I say more ? But i will, citizens and industry can run things just fine.

Thank you, Juno News, for shining a light on Canada’s economic stagnation with such clarity. Your piece underscores the harsh reality of our flatlining real GDP per capita, a trend that aligns starkly with the rising Energy Cost of Energy (ECoE) I explore in my recent Substack post at thegreatcanadianreset.substack.com. As Canada grapples with this economic inflection point, your reporting highlights the urgency for solutions of quality over quantity. I believe cooperative businesses—democratic, community-driven models like Coast Capital Savings or SolarShare—offer a resilient path forward, turning scarcity into shared prosperity. Keep up the incisive work, Juno News, for keeping Canadians informed and engaged!